Client Portfolio Insights & Growth Analysis on 965271954, 266051100, 7322304145, 604260319, 8552372293, 9172423844

The analysis of client portfolios 965271954, 266051100, 7322304145, 604260319, 8552372293, and 9172423844 reveals a carefully structured approach to investment, reflecting varying risk tolerances and financial objectives. Key trends indicate potential in emerging sectors, particularly renewable energy and biotechnology. However, a deeper examination is warranted to identify strategic avenues for growth that could enhance overall portfolio resilience. The implications of these findings merit further exploration.

Overview of Client Portfolios

While the composition of client portfolios can vary significantly based on individual goals and risk tolerances, a comprehensive overview reveals common elements that define successful investment strategies.

Key components include portfolio diversification, which mitigates risk, and thorough risk assessment, ensuring alignment with each client’s financial aspirations.

Such strategies empower clients, fostering a sense of freedom in navigating their investment journeys while optimizing potential returns.

Key Trends and Insights

As investment landscapes evolve, key trends and insights emerge that significantly influence client portfolio management.

Market fluctuations necessitate astute risk assessment and a focus on investment diversification to mitigate potential losses.

Additionally, adherence to performance benchmarks allows clients to evaluate their strategies effectively.

These elements collectively shape a dynamic approach to portfolio management, enabling investors to navigate uncertainties with greater confidence and agility.

Opportunities for Growth

Numerous opportunities for growth exist within the current investment landscape, driven by emerging sectors and innovative technologies.

Expansion strategies focusing on renewable energy, biotechnology, and digital finance present substantial potential.

Additionally, market diversification into underrepresented regions can enhance portfolio resilience and capitalize on untapped demand.

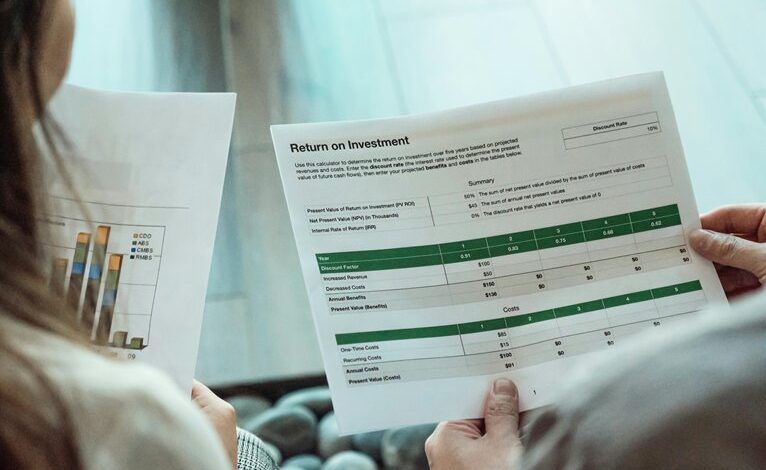

Strategic Recommendations

To capitalize on the identified growth opportunities, investors should adopt a multi-faceted strategy that integrates sector-specific insights with broader market trends.

Effective investment strategies must prioritize diversification, aligning with risk management principles to mitigate potential downturns.

Additionally, continuous market assessment and adaptive tactics will enhance responsiveness to changing conditions, empowering investors to navigate uncertainties while optimizing their portfolios for sustainable growth.

Conclusion

In conclusion, the client portfolios, akin to a well-tended garden, flourish through careful selection and nurturing of diverse investments. Just as a gardener identifies the most promising plants to cultivate, these portfolios strategically embrace emerging sectors like renewable energy and biotechnology, enabling them to thrive amid market fluctuations. By continually assessing and diversifying their holdings, clients can harvest the fruits of optimized returns, ensuring their financial landscape remains vibrant and resilient.