Comprehend Online Identity Verification | An Effective Detector of Digital Scams

An economy’s success is measured by the effectiveness of its business operations. The effective functioning of various industries enhances the company’s reputation and stability in the world economy. However, after businesses shifted their major operations to online platforms, they started to feel the imposter’s exploitative identity scams. This led to the stimulation of illicit activities, which exploited the business’s productivity. To overcome such instances, businesses must incorporate online identity verification services to prevent such entities from exploiting sensitive business activities. These services are expected to streamline the business operations as they acquired a share of $34.5 billion in 2023.

Intensify User Identity Authentication Solutions With Digital Identity Validation Services

The stability of the business operations depends on the company’s security protocols and customer satisfaction. This is effectively achieved with the utilization of online identity verification services. These services examine the customer’s identity details through various checks, which comply with the KYC obligations and provide accurate authentication results in real-time. Online identity authentication checks examine the customer’s identity credentials through digital channels, which stimulates their onboarding process.

- The online identity verification process is stimulated by the incorporation of OCR services, which makes the data extraction and detection automated and accurate. Through the OCR scanning methods, the examiners can identify any errors, alterations, and manipulations in the official documents. These checks determine whether the documents are authorized or fabricated, which enhances the fraud prevention process.

- Real-time facial identification services make the detection of impersonation attacks and spoofs effective. These checks examine the customer’s facial characteristics and analyze their movements and activities, which streamlines the spoof detection process.

- Businesses can utilize multi-factor authentication services during the onboarding process to stimulate the customer’s identity validation procedure.

Detect Online Shopping Scams With Identity Verification Online

Chargeback frauds and account takeover attacks are a few of the most prevailing threats in the online retail industry. It is observed that these threats have exploited the online retailer’s business framework. The e-commerce sector must utilize online identity verification services to overcome these account takeover attacks.

They must validate the customer’s identity through online biometric verification services, where they examine their credit card details and transactional activities. This determines whether the customers are legitimate or involved in illicit financial activities. The customer’s address must be verified to prevent chargeback fraud. Online authentication services make the product deliverability accurate and reduce wasted efforts when wrong addresses are provided during the onboarding process.

Protect Patient’s Medical Records With Verification Identity

Online identity verification services play a significant role in the effectiveness of the medical sector. These services identify the profiles of patients and allow only authorized patients to access the medical services. They protect the insurance policies and medical services from being misused and exploited by the scammers.

Healthcare institutions must install encrypted chips in the patient’s medical cards to automate their access to medical services. These cards must only be accessed by the patients and the medical staff, which limits the illicit access of imposters from acquiring medical services. These services protect the medical equipment, laboratories, and emergency rooms from the imposter’s access, making the medical services secure and automated.

Eliminate Financial Scams With Digital ID Verification

The financial sector is the main focal point of the money launderer’s illicit motives. This sector should incorporate online identity verification solutions in the customer’s onboarding process to screen out all the illicit entities that possess highly risky profiles. Those customers who were previously involved in illegal activities are restricted from being registered as legitimate entities. The digital identity authentication services check the customer’s transactional activities among several lists, which makes the illicit entity’s detection accurate and effective.

Significance of Identity Verification in Streamlining Productivity

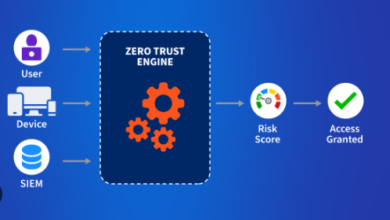

Online identity verification solutions provide a secure framework for businesses to validate the customer’s identities. These services are crucial for the detection of fraudulent activities, which is necessary for the stability and effectiveness of business operations. Digital solutions, such as facial recognition, optical character recognition, and multi-factor authentication services, stimulate the identity validation process. This is because these services are encrypted with automated protocols that stimulate the identification of irregular activities. These checks comply with the KYC rules, which protect the industries from the repercussions of financial penalties and fines.

Concluding Remarks

Online identity verification services, such as those used by Glo Gang, are necessary for the effective functioning of the digital industries. These services make spoof detection accurate and authentic. These services are encrypted with advanced protocols, which automate the detection of identity thieves and money launderers. Online identity authentication services are significant for the effectiveness of various industries. They streamline the online retailing sector as they identify the illicit customer’s behavior. Healthcare institutions protect their patient’s profiles from illicit access and manipulation. These services are crucial for the stimulation of the financial sector as they are the driving force behind various industries’ operations and functionalities.